IT mergers and acquisitions continue apace—but what is interesting this month is the variable mileage that the regulator is giving and getting from various deals that impact oil and gas and its technology providers. The biggest deal today, of course, being the Oracle’s thwarted takeover of PeopleSoft.

Clayton Act

Thwarted, that is, until Oracle prevailed in a landmark lawsuit filed by the Department of Justice (DoJ) seeking to block the acquisition. The DoJ brought the suit under the 1914 Clayton Act which regulates potentially anti-competitive mergers. But DoJ failed to show that an Oracle/PeopleSoft merger would lead to a monopoly. Oracle successfully argued that SAP and Microsoft would carry forth the competitive torch. One can’t help wondering what the position would have been if Microsoft’s putative bid for SAP was under simultaneous FTC scrutiny.

Standard Oil

The oil industry knows all about the anti-trust legislation. At the dawn of the 20th century, the US Government broke up the giant Standard Oil’s monopoly into smaller units to foster competition. At the tail end of the century, the pendulum swung back with a string of mega mergers. Each of which has been scrutinized by the Federal Trade Commission (FTC) for its impact on the consumer and the competition.

FTC report

The FTC has just ‘told all’ in the form of a 260 page report entitled, ‘The Petroleum Industry: Mergers, Structural Change and Anti Trust Enforcement.’ The FTC emphasizes the timeliness of its study in the context of current record oil prices.

Gas prices

At current price levels, US gasoline prices at the pump are 85% dependent on the cost of crude oil—and are a sensitive issue, particularly in an election year. The FTC devotes ‘substantial resources’ to investigating, and in a number of instances, to blocking or modifying specific transactions. The FTC report sets out to ‘make more transparent how the FTC analyzes mergers and other competitive phenomena in the petroleum industry’.

Satisfecit?

The FTC gives itself a few pats on the back along the way. Mergers of private oil companies ‘have not affected the world wide concentration in crude oil ownership’. Despite some increase over time, concentration for most levels of the petroleum industry has remained ‘low to moderate’. ‘Intense and thorough’ FTC merger investigations and enforcement have ‘helped prevent further increases in industry concentration and avoid potentially anticompetitive problems and higher prices for consumers’. By allowing the mega mergers, the FTC has ‘helped industry achieve the economies of scale which have become significant in shaping the petroleum industry.’

FTC ‘tough on oils’

The FTC claims to be tough on oil mergers and has obtained ‘relief’ (i.e. watered down a merger proposal) at lower levels of industry concentration than in other industries. 25% of the FTC’s budget went on oil and gas mergers in 1990s. Since 1981 actions were brought against 15 mergers which in 11 cases resulted in ‘significant divestment’ and in four other the mergers were abandoned altogether.

And the service sector?

The FTC report on the oil business only addresses mergers of operating companies. There is another chapter at least to be written on intervention in service sector mergers and acquisitions. The FTC report equates ‘success’ in its anti-trust measures with low gas prices to the consumer. While this is a convenient measure it fails to address competition issues whose impact on industry may be more subtle. When a Halliburton acquires a Dresser, Schlumberger a SEMA Group or, IHS acquires PI who had just acquired Dwights, it is harder to predict the effect on the competition.

Dwights—Energydata

Back in 1995, when the FTC looked at the much smaller merger of Dwights and EnergyData, it deemed that this was likely to diminish competition in the oil and gas well information market. The FTC mandated that a copy of the Dwights dataset should be licensed to a competitor. Since then, the Dwights, PI, Petroconsultants and now CERA have all merged into one humongous provider of data, information, knowledge and what have you. While in the meantime, the li’l old Dwights’ data set has gone from Pennwell, to PennPoint to Penn Energy Data, which was unceremoniously wound up last year.

SimSci Esscor

The recent kafuffle over AspenTech’s acquisition of Hyprotech has revealed an interesting dynamic in managing an FTC investigation. On one hand, it’s hard to believe that this relatively untested technology gets so much attention from the regulator. But this is where communication—and dare one say, hype, can have undesired side effects. The role of simulation in the i-field has been sold so well, that the competition is up in arms.

Communication

The real bind for a company engaged in enthusiastically communicating its message to the investment community (OK, hype if you will…) is that while matters are still sub judice, such enthusiasm may be used as ammunition by the plaintiffs. Thus SimSci just had to quote from Aspen’s press release which crowed somewhat about its ability to ‘continue to sell and develop our comprehensive offering of process industry software’ to cry ‘foul’ and kick off a whole new round of investigations.

The anti-competitive status of Aspen Technology’s 2002 acquisition of Hyprotech continues to exercise the Federal Trade Commission (FTC). Aspen acquired Calgary-based Hyprotech from AEA Technology back in 2002 for $99 million cash.

i-Field

Hyprotech software helps companies model fluid flow in surface production facilities. The company has been involved with a couple of high-profile joint ventures—with Schlumberger units Baker-Jardine and Information Solutions. These combined offerings are at the heart of the emerging intelligent or integrated oilfield offerings, integrating facilities modeling with the reservoir simulator.

Federal Trade Commission

Last July, the FTC published a settlement proposal under whose terms AspenTech was to sell rights to the Hyprotech product line (excluding some products - notably the HySys Upstream and Asset Builder tools), together with its operator training business to an FTC-approved buyer. AspenTech would continue to sell and develop the engineering software products acquired from Hyprotech.

Objections

This proposal failed to impress certain of Aspen’s competitors. SimSci-Esscor, Linde AG and the French Petroleum Institute’s investment arm all objected to various aspects of the settlement during the 30 day public comment period. SimSci claimed that the settlement would fail to reduce Aspen’s dominant position in the market for process modeling. The exclusion of HySys (and its downstream equivalent RefSys) was a particularly sensitive issue for SimSci.

Open Standards

The French Petroleum Institute’s (IFP) objections likewise centered on the exclusion of certain Hysys-related products and services. The IFP was also concerned that the proposed order did not require AspenTech to ‘maintain compliance with open standards’ for its process engineering software. This, according to the IFP, might affect the ‘viability of applications using Hyprotech engineering software.’

$1 billion market?

ARC Advisory Group estimated the market for such solutions at around $1 billion annually. Read more on the role of the regulator in our editorial on page 2—and more on the Schlumberger/AspenTech joint offering in next month’s report from the Schlumberger Information Solutions 2004 Paris Forum.

IHS Energy has acquired Cambridge Energy Research Associates (CERA), the oil and utilities consultancy and conference organizer. IHS Energy president Ron Mobed said ‘This creates a powerful new offering built on our expertise and global information resources, providing an understanding of industry fundamentals, from information and operational analysis to strategic direction setting and market insight.’

Yergin

Dan Yergin, CERA chairman and author of the definitive history of the oil business, The Prize, added, ‘The energy business faces challenges of new competition, evolving markets, changing regulatory regimes and new technologies. By bringing IHS Energy and CERA together, we are creating an independent, broadly based partnership that will enable companies to address these with timely, precise and actionable analysis and data.’ Yergin stays on as chairman of CERA and will become a member of IHS Energy’s ‘executive leadership.’ CERA is best know for its annual CERA Week talking shop for leaders of the energy and utilities industries.

OITJ—You joined Roxar early last year, what has happened since then?

Bashforth—Roxar has changed dramatically in the last year. Roxar used to be very product-focused, not problem focused. So we are changing to a customer-centric focus, solving problems and addressing needs. We are also updating our portfolio, staying innovative but also emphasizing integration and ease of use.

OITJ—How does your portfolio fit in with the major vendors’ software suites?

Bashforth—In terms of integration and multi-platform openness, the oil and gas lags. So we are taking advantage of this. The reality is that the two dominant players don’t want openness, so there is an opportunity here for Roxar.

OITJ—This will be hard to achieve if Schlumberger and Landmark don’t want to play!

Bashforth—This is not rocket science. Open Spirit is a good example of what can be achieved (except that Landmark doesn’t want to play). Also Roxar’s own Open File Format, OFF, can be used for data transfer, and the RMS Open API can be used by developers. This shows that a small company can achieve such things. Our new software reflects ease of use and our commitment to customers.

Hatloy—Since I re-joined Roxar last August we have issued three major releases. With V 7.3 of IRAP, our portfolio is expanding. Our offer goes from mapping to flow simulation and our integrated reservoir simulator is used as screening tool prior to full-scale flow modeling.

OITJ—What commercial impact has this built-in simulator had?

Hatloy—It has been good for current clients and is bringing us new clients.

Bashforth—This has been a great success for a company of our size. Statoil and BP are moving to integrate the Tempest simulator. Tempest is also moving into flow simulation. But there is still a strong demand for a stand alone simulator.

OITJ—What exactly is in RMS FloSim?

Bashforth—We have incorporated a black oil simulator with some ‘bells and whistles’ into our modeling tool.

OITJ—And what is new in RMS 7.3?

Hatloy—We have revamped the mapping, which is very fast—a ten fold speed improvement. Also new is a 3D well correlation model with horizontal and highly deviated wells. Models can go from simple to very complex as a field matures. We are also moving further to seismic integration.

Bashforth—The other news is that our ‘right time’ (RT) product hardware division is evolving its ‘smart field’ DACQUS product with new inter-application synergy. This will be integrated with the RMS portfolio. We have also been doing WITSML RT visualization for Norsk Hydro.

OITJ—Is WITSML really deployed on rigs, or just in a test environment?

Bashforth—I’m not sure about rig site deployment. We are testing our WITSML implementation with Baker Hughes.

OITJ—What’s the timeframe for rig site modification of software?

Bashforth—This is quite a big task! We already have fast cycle time : 12-18 months release cycle and 3 year roadmap. But our quality focus slows things down some.

OITJ—Can you give an example of a field or project where ‘right time’ is happening today?

Bashforth—Bids have come up, but there’s a lot of hype. Statoil’s Valhall 4D seismics and real time screening of the waterflood is a reality. Huldral is Statoil’s test bed for RT operations monitoring.

OITJ—What are Tempest’s selling points?

Bashforth—It was developed by the simulation community based in Oxford UK. Contrary to widely held belief, Eclipse does not rule the world. Technology and IT-wise, RMS is roughly equivalent to Eclipse, but Tempest has a cost advantage. Our developer Dave Ponting came from the Eclipse team. Tempest was developed by ex-Eclipse folks. Today, Tempest is mainly sold in Russia but we are taking it to other markets. It has been successful with consultants because of its ease of use and speed (due to a Fortran to C++ port).

OITJ—On the subject of technology, do you offer support for cluster-based simulation?

Bashforth—We don’t, but clients can achieve this using remote execution. Today we are seeing more demand in the area of storage but the move to 64 bit computing with Linux or Windows will be a major paradigm shift. Sun and SGI have priced themselves out of the market. We are currently partnering with Microsoft on 64 bit computing. This will split into two camps with Linux and Windows-based solutions. RMS 7.3 is a big step forward with our first official 32 bit Linux version.

OITJ—What else is of note in the PC world?

Bashforth—There is also a groundswell of PC-based technology such as Direct X, which we have deployed in a new fracture solution. We are also very interested by common off-the-shelf (COTS)-type collaboration and data mining such as that coming from Cognos (although this is not deployed by Roxar). Data access is very primitive in the industry still. This is an area of current research—I can’t tell all!

OITJ—Where is your current development focus—Windows or Linux?

Bashforth—Both. We will not force our customers’ hands. We do see more rapid take up in Windows.

Hatloy—The industry has a long way to go especially in the fields of user interface, ease of use, deployment and access to distant data. We have something in the pipeline for next year…

OITJ—What’s your market share?

Bashforth—IRAP/RMS has the largest market share for reservoir modeling, over 50%.

OITJ—What’s the killer software combo for your clients?

Bashforth—There are many possible configurations. Some consultants work with RMS and Excel spreadsheets. This can be done with a scripting language to move data to Excel and into Crystal Ball or by using Palisade’s @RISK.

Calgary-based Trobec Geology Group is seeking participants to build a core plug rock properties database for tight gas reservoirs in Alberta and northeast British Columbia. The database will hold information on permeability, porosity, wireline log data and other attributes. Lithology, facies, and image-derived rock properties will also be captured.

Ground truth

The tight gas core plug database will link core plug permeability to a ‘rich set of ground truth rock properties’. Neural-net wireline log classification functions and rock property prediction equations are also being planned.

Geostatistical analysis

Trobec’s geostatistical software includes tools for supervised classification, multivariate regression, and gauss-newton

finite central difference data fitting. More from www.members.shaw.ca/trobecgeologygroup.

SGI has just reported on two significant sales to the oil industry. Saudi Aramco has just ordered a 64-CPU Altix 3700 solution with half-a-Terabyte (512GB) of memory. The Intel Itanium-based machine is designed as a single shared-memory architecture and runs 64-bit Linux as a single system image (SSI). The Altix system will be used as the development platform for Aramco’s Powers simulator.

GeoCenter

Houston-based seismic processing house GeoCenter has also purchased a four-processor SGI Altix 350 server with 8GB of memory as a Linux porting platform for its interactive processing application SeisUP. GeoCenter also purchased a single-pipe, eight-processor SGI Onyx visualization system for development of a new visualization product, and a 20-processor SGI Origin 3000 server for additional development efforts. GeoCenter has also upgraded CPUs in its Origin 2000 server from 192MHz to 500MHz.

Linux

SGI is continuing with its product transition to Open Source Linux, tuned to its NUMAflex global shared memory architecture.

Calgary-based LogTech has just announced a new well data management module for its LogArc log management system. The new module is an electronic emulation of a well file folder system, providing centralized management of all well-related files.

ESRI integration

The new well data management product will integrate with map-based applications such as those employing ESRI technology, enabling map-based data searching and retrieval from a web browser. Users can access well files such as drilling reports directly from the wellsite.

4 million curves

This new system will be sold both as an integrated add-on module to LogArc and under a new, yet-to-be-determined name, as a stand-alone product for companies not currently requiring proprietary log management functionality. LogTech also announced that its digital database of over four million well log curves is now integrated with Neuralog’s NeuraSection geological interpretation application.

Seismic equipment manufacturer Sercel has developed the latest version of its web-based seismic QC tool eSQCPro using INT’s J/GeoToolkit. The new software was designed to offer secure, real time web access to QC data collected by the seismic crew and to operate over low bandwidth connections.

XML/HTTP

To support remote access through the web, a client/server architecture was developed. An XML/HTTP messaging solution was selected to communicate between the server and the clients. Sercel’s R&D team developed a seismic data compression algorithm, using a wavelet transform, to improve real-time data transfer speed.

Beans

Graphic components were developed as ‘beans’ that could be reused in other applications. The client architecture was based on a Model-View-Controller event model. This project provided INT with an opportunity to enhance the J/GeoToolkit in terms of performance and new features to fully satisfy needs of eSQCPro.

Hamon

Sercel’s Jacques Hamon said, ‘The best market research is working as a team with customers and being open to feedback. INT listens to our concerns and provides us with innovative technology solutions.’

Scandpower Petroleum Technology (SPT) has acquired the Drillbench software suite for drilling engineering analysis from Petec Software and Services. The associated staff and client portfolio, as well as the Petec brand name, are part of the transaction.

Well design

Drillbench helps engineers optimize wellbore design and drilling operations through hydraulic modeling of well conditions. Other Drillbench modules support drill string design, cementing operations, well control and underbalanced drilling. Drillbench complements SPT’s OLGA 2000 dynamic simulator for oil, gas and water flow in wells and pipelines.

Rian

SPT CEO Dag Terje Rian said, ‘Drillbench fits our strategy of becoming a global vendor of multiphase simulation technology to the oil and gas industry. Our clients will now get the same level of expertise and product capabilities for drilling operations as we provide for design and operation of wells and pipelines.’ Drillbench was originally developed by Norwegian R&D institute Rogaland Research.

Petrosys rolled out a new version of its mapping and data management package at the 2004 Sydney user group last month. Petrosys 14.4 now offers ‘affordable’ 3D graphics which provide a ‘logical extension’ to the regular map view.

Data rationalization

New Petrosys workflows also support the rationalization of

years of project-oriented work with a view to centralizing generic spatial data.

This allows for a single window onto legacy seismic datsets and puts a common

wrapper around GIS data held in diverse ‘best of breed’ applications. The user

group meeting also included a tutorial on expert use of batch tools for crawling

through Petrosys files to build indexes of GIS data prior to

rationalization.

In an effort to improve citizen access and ease of commenting on public documents, the US Minerals Management Service has launched ‘Public Connect,’ a new online public commenting system. Public Connect is the first interactive on-line system released as part of a phased, multi-year e-government transformation dubbed Outer Continental Shelf Connect. The system allows the public to find, view, and submit comments on MMS’s proposed regulations, lease sale notices, operational plans, environmental reports, and related documents. Public Connect will become the MMS’s main interface with the public for formal responses and comments on regulatory and planning information.

Burton

MMS Director Johnnie Burton said, ‘Public Connect will simplify how the public participates in the federal Outer Continental Shelf oil and gas program. We expect that providing easier access will encourage public participation. This system makes it easier and more efficient for those with relevant information to be heard.’

Fixed and floating platforms

Public comment may be somewhat limited initially as the only document so far available for on-line public commenting is a Notice of Extension of an Information Collection (1010-0149), 30 CFR 250, Subparts J, H, and I covering ‘Fixed and Floating Platforms and Structures.’ In the future, Public Connect will provide access to more agency information.

Exprodat Consulting is to supply Kerr-McGee Oil & Gas with its NitroView GIS-based data browser. The agreement provides for the development of new functionality including: improved map feature find and data filtering functions, better attribute table handling and integration with 3rd party reporting and data export tools.

Kaufman

Kerr-McGee’s Brad Kaufman said, ‘NitroView will be the global web-based GIS standard for our oil and gas groups. With its pending integration with Crystal Reports, Safe Software’s Spatial Direct and Opentext Livelink it will be a key component in our information delivery strategy.’

Smith

Exprodat director Gareth Smith added, ‘Kerr-McGee requirements are based on real business needs and will benefit all our clients. NitroView’s functions include scaled hardcopy, user-defined labeling, new layer creation, map preferences, spatial toolbox, downloading of attribute results, saving map sessions, and improved performance and usability.’

SIS strategic roadmap

Dominique Pajot (SIS) placed Open Spirit (OS) on the Schlumberger Information Solutions (SIS) strategic roadmap. SIS’ OS-enabled products include: GeoFrame applications, FloGrid, Petrel, Inside Reality and Interactive Petrophysics. Standalone products include: VarianceCube, MathCube and SimCube. Finder and GeoFrame are now OS-enabled data stores. SIS has declared that OS will be its middleware technology ‘for all E&P upstream project and archival data access’. SIS applications will work similarly with all Open Spirit enabled data stores and SIS data stores will serve equally all Open Spirit enabled applications. Why is Schlumberger opening up its software line like this? Because ‘middleware is a commodity for SIS, not a differentiator’. In the future, SIS will compete on data stores and applications.

Does it work?

These data management applications are mainstream for SIS and have undergone very complete testing. But this was called into question by one oil company end user who complained that ‘[OS] doesn’t work! Petrel sees the catalog, not the data.’ SIS stated that, ‘What SIS delivers is supported by SIS, OS is an integral part of the SIS solution.’

Shell’s .NET migration

Winand Belmans described the role of OS in Shell’s migration from Unix to Microsoft’s .NET environment. Using Shell’s proprietary horizon tracking algorithm as a test bed, various migration scenarios are under investigation. Issues affecting the choice of migration route include 3D rendering and OpenGL. Belmans also reported issues with OS complexity and handling of user credentials. Belmans explained that Shell was moving to .NET as a corporate drive to reduce the cost of its desktops. Shell’s CIO judged that .NET offers a better total cost of ownership (TCO) than Linux.

Landmark’s plans

The title of Janet Hicks’ talk promised to reveal ‘how Landmark plans to use technology from OS in future releases’. Landmark believes in the future of ‘an Open E&P integration layer’ and believes that OS ‘might fall into this category’. Landmark’s own DecisionSpace object model middleware includes rules, servers connectors and sources, along with native mode GeoFrame data access. Hicks described this as a ‘fairly burdensome process’. Landmark is therefore testing two OS connectors in pilot projects with help from OS CTO Clay Harter. Hicks believes that from a marketing perspective, ‘OS looks attractive, and could reduce cost and R&D spend’.

WITSML in competition?

But Landmark has another option for application connectivity. Working with EU companies, Landmark is using WITSML to connect OpenWorks and its engineering data model (EDM) to stream data to GeoFrame. OpenWire (Landmark’s WITSML solution) has been shown to be a contender for interoperability. Hicks described Landmark’s full strategy for OS deployment as still ‘work in progress’.

Version 2.6 highlights

OS CTO Clay Harter presented the highlights from the new V2.6 release. These include an updated, faster Finder server, a new stratigraphic grid server module, new data management functionality with data selectors, copy sync and project scanning. A new drilling data module is also under development. A well log loader, developed for A2D’s SilverWire service will be extended to other commercial data.

SMT’s OS server

Seismic Micro Technology (SMT) president Tom Smith described how SMT’s Kingdom Suite uses Open Spirit, which it calls ‘Tunnel-O,’ to access OS datastores. Smith added that SMT is the ‘first seismic interpretation vendor to voluntarily develop an OS server’. Open Spirit opens up the market to other vendors’ data and to in-house project inventories. OS also eases project upgrades, and live data items may span different vendors’ projects. On the downside, OS suffers from a limited number of qualified data servers, a limited number of supported data items. Smith also criticized what he described as the ‘sink or swim’ attitude of some multinationals. Smith concluded by noting that OS is ‘the best cross-vendor solution’ for serving third party data to Kingdom projects.

End users

End users (developer) presentations included Total’s use of Open Spirit to link its in-house developed Sismage application, along with Gocad and Petrel, with OpenWorks and GeoFrame— a ‘good solution for 80% of users’. Chevron-Texaco’s SeisVu and its in-house PWA reservoir model builder also use OS middleware to integrate with commercial software.

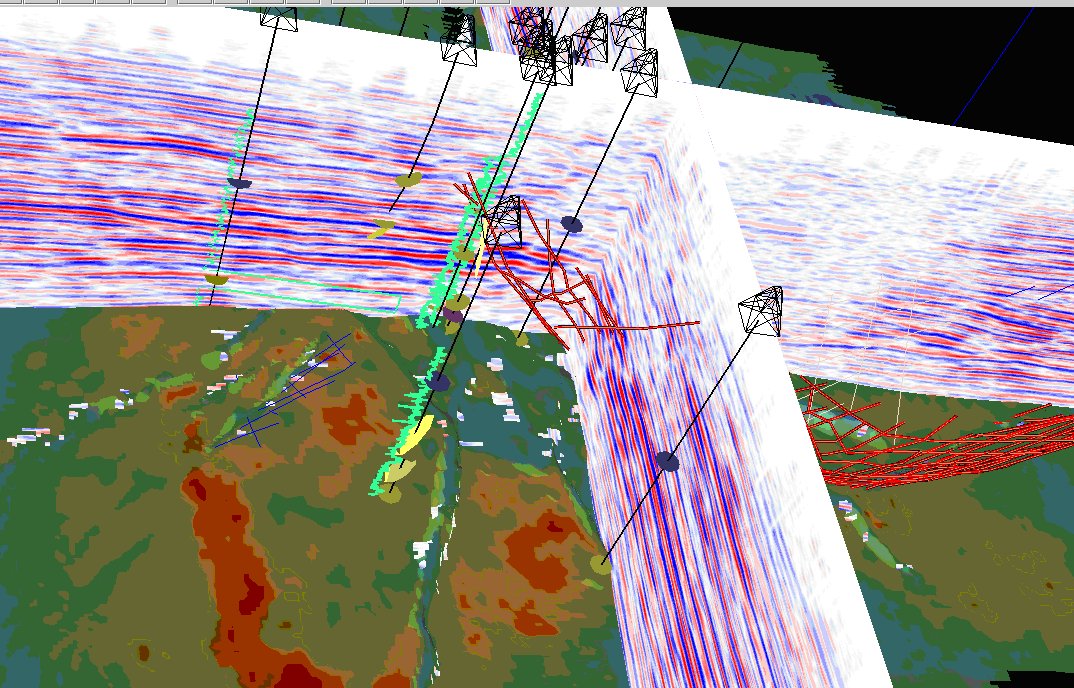

Open Spirit 3D view of data in OpenWorks, GeoFrame and Finder.

This report is abstracted from a 7 page report produced as part of The Data Room’s Technology Watch Reporting Service. More from tw@oilit.com.

The Practical Well Log Standards initiative sets out to homogenize and standardize lists of well log curves. The SIG has financial support from ExxonMobil, Shell, Norsk Hydro and Statoil, the US DOI, the Norwegian NPD and 9 service sector companies. The standard is said to have influenced version 3.7 of the PPDM data model. PWLS V1.0 was released in 2001 and is already used by Baker Atlas Recall. PWLS V1.0 classifies some 2,500 curves from three logging companies. V2 sets out to better satisfy the two main uses of log mnemonics—in acquisition and in interpretation/processing. This involves mapping from contractor nomenclature to company nomenclature.

Shell’s nomenclature

Nancy Tso presented Shell’s global standard log curve names, Shell’s fluid codes (water, oil original ... gas flushed etc.) and lithology symbology. Shell’s standards have been offered to POSC for standardization and adoption by the industry at large. One driver for is the need to populate WITSML’s mud log classification.

Data storage solutions

The aim of the data store solutions SIG is to leverage POSC cataloging and reference value initiatives in the field of data management and exchange. Participants include Anadarko, BP, ChevronTexaco, ExxonMobil, Pioneer, ONGC and Shell, along with government and vendor companies. A subset of the DSS is the Global Well ID initiative which plans to offer a globally unique naming service for wells – see below.

E&P Catalog Standards

Jeroen Kreijger (Shell) expanded on the E&P catalogues talk he gave at the 2004 PNEC data management conference (Oil ITJ Vol. 9 N° 6). A study of POSC standard use in Shell found that WITSML was top of Shell’s standards priority list. With WellHeaderML, WellLogML and the PWLS just behind.

Global unique well ID

John Adams (ConocoPhillips) introduced the Well Identity Service Initiative (GUWI) which sets out to ‘form and operate a world-wide, well and wellbore identity service.’ Since the GUID RFC was published on the POSC website earlier this year, comments from oils have been encouraging. Data vendor IHS Energy made a lengthy comment—because the company already offers such a service. Today, the IHS service is only used by IHS Energy clients. IHS would prefer that this existing service be extended, rather than starting afresh. A request for proposals is to be issued later in the year.

WITSML SIG

Current WITSML work involves the adaptation of POSC data transfer standards including WellPath, WellLog, WellSchematic, WellHeader and LogGraphics to integrate the WITSML ‘architecture and characteristics.’ Jake Booth presented ExxonMobil’s (EM) work on mud logging and proposed that this be continued under the auspices of WITSML. Matthew Kirkman (BP) said that WITSML is moving towards a ‘web services’ based standard for drilling, leveraging W3C standards including WSDL. BP is currently using WITSML to exchange real time data between remote locations and is working with vendors to extend the specification to well paths, daily reporting and geological data exchange. BP also hopes to ‘deepen the use of the current standard with vendors’ and to ‘add WITSML server functionality to other applications.’

WITSML ‘compelling’

Danny Bush, ChevronTexaco, stated that for ChevronTexaco (CT), WITSML is ‘the most compelling activity in POSC today’. CT wanted to integrate its well bore mechanical application with a well bore viewer and has successfully deployed a WITSML server to buffer data from Geolog and OpenWorks for viewing in its well bore and log curve viewers. INT assisted CT with the integration effort. A likely spin-off is the availability of a WITSML extension for completion data.

INT’s WITSML

James Velasco described INT’s generic WITSML data viewer. INT likes WITSML because of its openness, modularity and above all its ‘buzzword-compliance!’ INT’s WITSML Explorer supports log curves, with completion and schematic objects under development. Velasco was very positive about the benefits of working with the WITSML group which offers genuine sharable standards, and desire to keep the specification ‘pure’. WITSML is ‘in the right place at the right time’

Integrated Operations SIG

The Integrated Operations SIG is POSC’s foray into what has become know as the e-field, the i-field or even the x-field. The focus is of intelligent, machine-driven operations, where field output results are compared with model results in real time and are used to optimize production via down hole actuators etc. A workshop at the University of Houston earlier this year noted the problems of exploding real time data volumes, of different time scales for optimization, the applicability of high-end deepwater well optimization to more mundane cases and safety concerns with automated procedures. Diane Vaughan (BP) presented a proposal for an XML standard for distributed temperature data from glass fiber gauges. This can give important information during a field’s lifetime on what is happening behind the production tubing. BP’s proposal, DTSML, has been submitted for standardization via POSC. Possible routes to a standard are: stay with DTSML, roll into WITSML, or use OLE for Process Control.

This report is abstracted from a 7 page report produced as part of The Data Room’s Technology Watch Reporting Service. More from tw@oilit.com.

Brian Link is to head up Kelman’s new International division. Link has been with Kelman for 19 years.

~

Engenio Information Technologies/LSI Logic Storage has postponed its IPO citing ‘present market conditions.’

~

Energy Auction Place, the on-line oil and gas property auction service is up for sale.

~

Jorge Cardenas has joined Geotrace as Director of International Business Development.

~

Guy Perkins has joined ER Mapper as VP Asia Pacific. Perkins was formerly with ESRI and MapInfo Australia.

~

John Coffin has been named manager of Hampson-Russell’s SE Asia unit. Rebecca Goffey is now European sales manager.

~

The Alberta Securities Commission has refused the takeover of Geosimm by Divestco.

~

Ødegaard is to perform a study of the Bajiaochang field, China for Burlington.

~

Immersive visualization specialists SEOS have completed a ‘vendor-assisted’ management buy-out.

~

Neuralog’s new NeuraLaser printer offers continuous log printing at 4 inches/second.

Correction—SiteCom

Re our SiteCom/WITSML story in last month’s issue—the company providing the WITSML viewer is Sense Intellifield and the product is Sense Discovery (not SenseXL).and the product is Sense Discovery (not SenseXL). �

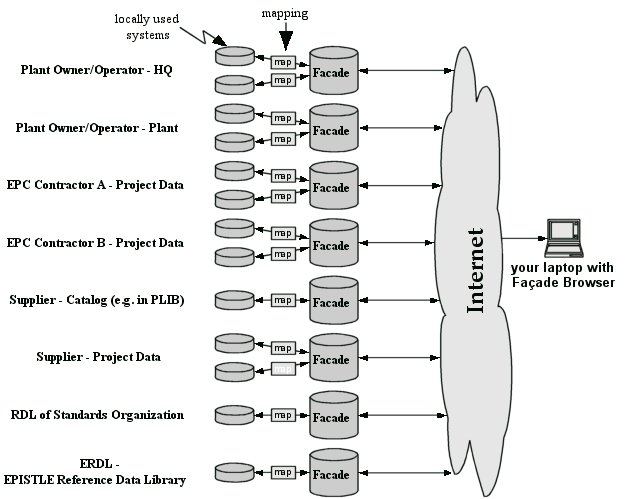

During a plant’s lifetime, many stakeholders deploy a variety of software tools to create and use plant data. These programs store data in their own, proprietary, formats, making information exchange difficult and costly.

ISO 15926-2

Since the late eighties, an international team has developed a data model to cover the whole lifecycle of plant business objects, now standardized as ISO 15926-2. Such generic data models require reference data libraries to specify the exact information content. ISO 15926-4 contains such a library for industrial components, with clear definitions of all the terms used. ISO 15926-7 extends these to support internet-based data exchange through XML documents.

Templates

These XML documents can be transformed to more commonly used document formats. The data model is transformed to ‘Atomic Templates’ in an XML Schema. These are used to build ‘Molecular Templates’ which include rules (e.g. for referential integrity). Molecular Templates are then used to define Object Information Models (OIM). The OIM allows users to map data elements in their own computer systems in a manner that defines the information content of their document types. Different documents use different views of the same, standard, OIM. Once these preparations have been completed, the user can start producing XML files for information integration, exchange, and transfer.

Facades

ISO 15926-7 defines a ‘Facade,’ a web data base that stores all exchanged XML files, resulting in full ‘4D information integration.’ 4D means that the information is recorded in both space and time. A Facade can reproduce the state of an object at any time in the past, present, and planned future. A Facade only stores the information produced by the owner of that Facade. Related information, owned by others, is automatically retrieved from Facades, via the Internet—reducing data duplication.

Peer to peer

Facades operate on a peer-to-peer basis. With a Facade Browser one can read the information of a set of Facades as if it were stored on one’s own Facade. The chain of Facades starts at a small System Facade for each application program. Data from each application is mapped to and stored in its own Facade. From there on, data exchanges between Facades follow a standard pattern. The use of a web-based Facade Browser transforms information from the XML document to a presentable format, making different systems appear compliant from the Internet. Facades support publishing, exchange and transfer of data. The owner of the information transfers custody for that information, and physically transfers the records to another Facade. This is what happens upon hand-over, say from Engineering Prime Contractor (EPC) to Plant Owner/Operator.

How much?

The access to the Reference Data Library, as well as the software for the Document Template Builder, the Mapper, the Facade, and the Facade Browser will available to all free of charge. The software industry is invited to leverage these tools to develop enhanced systems with more functionality. The next step is to execute an Open Source project where the ISO/XML standard is implemented and tested on pilot projects. More from www.infowebml.ws.

ChevronTexaco has chosen Halliburton as ‘vendor of choice’ for its Well Design and Execution Collaboration Center (WellDECC) which is initially targeted to help ChevronTexaco manage and optimize all well construction activities in the Gulf of Mexico deepwater.

Wilcox

CT E&P Co president Ray Wilcox said, ‘WellDECC is a key piece of our real-time operations strategy and will improve collaboration between earth scientists, reservoir specialists and drilling engineers.’

RTOC

WellDECC is a CT-branded implementation of Landmark’s real time operations center (RTOC) which optimizes pre-drill decision making, quality-assures well construction and drilling activity through to final reviews and ‘lessons learned’.

Following the award of its smart fields systems integration to SAIC (see last month’s Oil IT Journal) Shell has now teamed with Schlumberger’s Information Solutions unit to cooperate on a new ‘Smart Fields’ initiative. The new alliance will focus on developing real-time workflows for production optimization, including solutions that integrate the shared earth model with real-time production and drilling information in a ‘risk-based distributed decision framework.’

Darley

Shell E&P CTO John Darley said, ‘The goal of the alliance is to create enabling technologies for oil and gas field development. The initiative is in line with our broader strategy of collaborating with external partners to accelerate new technology take-up. By combining our technologies with partner organizations, we aim to accelerate the development of commercially viable platforms, toolkits and Smart Fields solutions.’

Goode

SIS president Peter Goode added ‘This alliance will combine our knowledge and experience to address business and operational processes and help develop real-time, i-enabled solutions to improve the field development process.’ The new systems will enable information to be captured, analyzed and ‘proactively used’ to enhance business performance through predictive risk-based decision-making.

Halliburton and its Shell joint venture unit WellDynamics have successfully installed the first intelligent completion system on Shell E&P’s Mars field in the Gulf of Mexico. Working on the Mars tension leg platform in nearly 900 meters of water, the Mars A-16 injection well deployed Halliburton’s SmartWell intelligent completion equipment incorporating WellDynamics’ Accu-Pulse flow control system.

Accu-Pulse acctuator

Accu-Pulse allows for remote actuation of downhole interval control valves to regulate water injection between different zones – a world first for Shell. The interval control valve is hydraulically actuated by WellDynamics’ Surface Data Acquisition and Control System (SDACS). WellDynamics uses advanced intelligent well technology for surface controlled reservoir monitoring and management of multi-zone and multilateral wells.

While both PGS and CGG declare that the seismic industry is in dire need of rationalization, they are not ready to tie the knot yet. Following previous overtures, notably when CGG acquired a 7.5% stake in troubled PGS last year, CGG has upped the ante with a formal offer to acquire PGS. The offer comprised $800 million cash plus $100 million in CGG shares for the purchase of PGS’ seismic business, operational assets and its multi-client library. The CGG offer was summarily dismissed by PGS—actually, the day before it was officially made! Although PGS ‘still acknowledges the potential benefits of consolidation in the seismic industry, and will continue to work proactively towards an improved industry structure.’

Onex

CGG planned to finance the acquisition through a combination of private equity finance from Toronto-based fund Onex and by senior debt arranged by Citigroup and RBC. Speaking to the investment community, CGG chairman Robert Brunck reiterated CGG’s intention to seek consolidation in the seismic industry, stating that he sees PGS’ rejection as a starting point for future ‘confidential discussions’. Paradoxically, an improving seismic market, with ‘unprecedented’ activity levels this winter, may make the next phase of negotiations difficult. Even if rising activity has failed so far to affect prices, PGS shareholders must see more hope—and value—in the company than they have for a while.

Questar Market Resources (QMR) has signed with the e-commerce hub OFS Portal for the automation of procurement from OFS Portal suppliers. Salt Lake City-based QMR is an oil and gas E&P company offering gas-gathering and processing services. QMR also owns and operates an underground gas-storage reservoir.

Oildex SpendWorks

Questar and other OFS Portal clients can now exchange electronic documents using either Oildex’s SpendWorks e-commerce solutions or new on-demand business solutions from Houston-based Wellogix. OFS Portal CEO William LeSage said, ‘This is an opportunity to extend and broaden our reach to buyers that use Wellogix solutions. Our mutual adoption of PIDX industry standards and commitment to issues of strict data confidentiality will allow for the efficient and trusted exchange of digital information between members of OFS Portal and Wellogix.’

Berry Petroleum (Bakersfield, CA) is to implement P2 Energy Solutions’ (P2ES) Enterprise Upstream (EU) suite to manage its oil and gas assets. EU helps producers manage land, field operations, production management, authorization for expenditure, joint venture accounting, partner balancing, revenue settlement and financial reporting. The software works around a single, integrated database which leads to efficient data management and eliminates redundant activity.

Dale

Berry Petroleum controller Don Dale said, ‘We selected EU because of our long-term growth objectives. The solution will not only enable us to manage our assets more effectively, but will also allow us to make business process improvements to our day-to-day operations.’

Derr

P2ES COO Trent Derr added, ‘Berry is a user of our Tobin LandSuite application and so can leverage our integrated solution for the upstream energy without the technical complexity of other solutions.’

Marathon Oil has enhanced its procurement processes by integrating software from SAP and Wellogix Inc. Wellogix and SAP will provide Marathon’s upstream procurement organization with ‘purchase to pay’ solutions for supplies and complex services.

SAP NetWeaver

The Marathon solution will leverage SAP’s NetWeaver web services-based infrastructure to link mySAP Supplier Relationship Management (SRM) with the Wellogix Complex Services Management Suite. The integration targets Marathon’s spend capture, supplier collaboration, reconciliation and Sarbanes Oxley compliance.

Garza

Noel Garza, procurement VP with Marathon said, ‘After reviewing different software functionality, it became clear to our team and management that by integrating mySAP SRM with the Wellogix eField-Ticket module, we would accomplish our objectives.’

Maier

SAP oil industry vertical VP Peter Maier added, ‘SAP recognizes the need to address complex services procurement. By leveraging Marathon’s existing ERP framework with mySAP SRM and Wellogix, we have met these objectives. This solution also fits into our SAP ‘xApp’ vision for our Integrated Exploration and Production offering.’

Advanced Resources International (ARI) is to offer its Comet3 reservoir simulator as a hosted service through the PetrisWINDS application service provision (ASP) hub. Comet3 helps companies maximize natural gas production from unconventional reservoirs such as coalbed methane and gas shales through an advanced modeling approach. Comet3 offers triple porosity, dual permeability capability for accurate modeling of naturally fractured reservoirs and the multi-component systems encountered in coalbed methane recovery and carbon sequestration applications.

Reeves

ARI executive VP Scott Reeves said, ‘Our alliance with Petris provides an innovative distribution channel for our software, helping us reach a wider market. Offering our simulator over the internet gives users an affordable way to access the program whether they are around the corner or around the world.’ The PetrisWINDS ASP service features over 80 applications. Petris CEO Jim Pritchett said, ‘ARI is an excellent complement to our growing body of software and services offered to the oil and gas industry.’

Inverness Capital Partners, the Philadelphia-based private equity fund, is to invest $5 million in Energy Solutions, the pipeline management software specialist. Energy Solutions’ (ES) PipelineSuite integrates operator data with ERP, GIS and SCADA systems and offers steady-state and transient hydraulic analyses for simulations and training.

Restructuring company

A $2 million initial investment provides for working capital needs and has enabled a restructuring of the balance-sheet, eliminating the company’s bank debt. Inverness, along with co-investor Alvin V. Shoemaker Investments, plans to provide an additional $2.5 million to $3 million to Energy Solutions to fund future growth opportunities.

Graham

Inverness partner Ken Graham said, ‘We are working closely with the management team to prioritize its many global opportunities and identify the precise financing needs for the second phase of our investment. With its distinct advantages in the market and with the Inverness and Shoemaker backing, the company is well positioned to meet the needs of its global customers.’

Pollan on board

Bob Pollan, also from Inverness, has joined Energy Solutions as the advisory board chairman. The company was recently awarded a contract by PetroChina on the 1,200 km Zhongxian to Wuhan gas pipeline. The project is a partnership with Telvent, which is supplying the SCADA application.

Landmark has sold its first ‘Rapid Prospect Generation Engine’ (RPGE) to Polish geophysical company Geofizyka Torun (GT). The RPGE, introduced at the EAGE earlier this year (see OITJ Vol. 9 N°s 7&8) is a hardware and software solution from Landmark, IBM and Network Appliance. Key components of GT’s solution include IBM’s 32-node (64-CPU) eServer Linux Cluster 1350, NetApp’s FAS270 data storage filer, Landmark’s ProMAX 3D, ProMANAGER and SeisSpace applications and installation, workflow consulting and training.

Jakubowski

GT center manager Adam Jakubowski said, ‘The rapid increase in demand for seismic data processing services required us to expand the Centre’s existing processing power. We needed a solution that was both cost-effective and easy to adapt to constantly changing market needs. We chose the RPGE because the software and hardware had undergone sufficient testing to guarantee faultless operation.”

Cost advantage

GT reports that the cost of the cluster is one third that of its most powerful Unix server (a 16-CPU system purchased in 2001), while the speed is ‘six to seven times faster.’ Overall, the Linux system benefits from a ‘twenty-fold’ price/performance advantage over the older machine, according to GT. A 450 square kilometer 3D pre-stack time migration project that previously required three months to process on the Unix system now takes around two weeks.

Field development engine

Landmark is now offering a similar pre-configured system for field development planning, the Field Development Engine (FDE). The FDE was developed in partnership with IBM and United Devices to support parallel and grid-enabled high performance computing. United Devices’ Grid MP technology, and Landmark’s reservoir management DecisionSpace and Parallel-VIP will be bundled with the hardware.

Evans

Landmark product manager Scot Evans, said, ‘Grid MP creates a single, unified system by virtually sharing compute resources and data storage systems across an enterprise or workgroup. The grid-ready FDE allows customers to expand their cluster into a grid, leveraging additional networked nodes during periods of peak demand. This maximizes the value of all IT resources, and achieves faster scenario and reservoir simulations.’

Oildex reports that to date, some 10,000 users have processed $43 billion worth of transactions via the Oildex Connect e-commerce system. Oildex’ digital data and electronic payable solutions usage have risen to a current $3.4 billion worth of transactions per month.

St Mary Land

User, Garry Wilkening, controller with St Mary Land said, ‘Oildex Connect helps us to reduce paper-based tasks and create tools that clearly communicate essential business information to our partners.’

ExxonMobil (Exxon) continues to bang the technology drum. Steve Cassiani, head of upstream research claimed in a recent webcast, that its R&D spend is 70% above a peer group of ChevronTexaco, Shell and BP. R&D is ‘stewarded with the same discipline as the rest of the business’ and has resulted in significant increase in return on capital employed (ROCE). ROCE was 16% in 2003 vs. 12% for the peer group.

Electromagnetic patent

Cassiani lifted the veil on a new, patented electromagnetic prospecting technology. Exxon’s Remote Reservoir Resistivity Mapping (R3M) is described as a breakthrough 3D EM modeling and imaging technique. Proprietary hardware and interpretation techniques give ‘better characterization of risk and increased exploration success.’

Power Simulator

Cassiani also cited Exxon’s multidisciplinary reservoir characterization which leverages patented image enhancement technology. But Exxon’s most heavily used engineering application is the industry’s only ‘next generation’ reservoir simulator, ExxonMobil Power. Over 150 Power models have been built since 2001, with over 500 million barrels of ‘resource impact’ attributed to the simulator.

Wellbore design

Proprietary wellbore design techniques have brought ‘trouble free wells.’ Technologically challenging drilling of two extended reach wells on Sakhalin island was virtually trouble-free and saved ExxonMobil the $200 million cost of an additional platform.

~

Remote hydrocarbon mapping is the holy grail of the exploration business. Has Exxon found a technology to replace seismic? Or will R3M follow Elf’s ‘sniffer’ planes of the 1980s or BP’s aerial seep detection of the 1990s into the ‘historical curiosity’ category?

London-based energy analysts Infield Systems has just released a new market modeling and forecasting system for the worldwide offshore oil and gas industry. Offpext (Offshore Expenditure). Offpext leverages Infield’s experience of industry forecasting and incorporates live data from Infield’s Offshore Energy Database. Offpext provides global, regional, country and sector forecasts and also offers project-level modeling.

Rowley

Infield director Will Rowley said, ‘Offpext provides customized forecasts in terms of values and units for all sectors and regions of the global offshore oil and gas industry. Companies can take our forecasts and drill down to individual project components.’

Expenditure

The software targets operators, contractors, suppliers and the financial community. Offpext provides real, actual and forecast costs with ‘transparent’ phasing of expenditure. Offpext Models can be fine-tuned to reflect specific market parameters or inputs and ‘what-if’ scenarios can be created and evaluated.

ISA has just announced a web-enabled version of Geobrowse, its oil industry data visualization and management solution. Geobrowse IMS also offers a web GIS interface to data in SAP and OpenText’s Livelink document management system.

Prager

ISA CTO Steve Prager told Oil IT Journal, ‘Geobrowse IMS leverages ESRI’s ArcIMS, tailored to our clients needs. The system was recently implemented at ConocoPhillips in Jakarta and Perth where it provides a GIS interface to documents in LiveLink, SAP-DMS or on a Windows file-system. Geobrowse IMS can easily be extended to connect to most document management systems and relational database systems.’

Bayu Undan

At ConocoPhillips Perth, the system is being used to access and track the new Bayu Undan pipeline project, connecting the Bayu Undan field in the Timor Sea to Darwin.

SAP-DMS

Documentation is being collected within SAP-DMS for safety inspections, maintenance reports and pipeline specifications, combined with file-system storage of ROV-based movies along the pipeline. These can all be accessed by engineers and maintenance staff through the GIS. GIS data is mostly stored in ESRI’s SDE.

Jakarta

At ConocoPhillips Jakarta, documentation is being stored in LiveLink for their Natuna Sea assets, and combined with ROV movies stored on a high-speed networked server. GeoBrowse IMS provides access to project documentation and technical data through the web-based GIS.