To a person with a hammer, everything looks like a nail. To an Enterprise Resource Planning (ERP) vendor, all enterprise IT looks like a potential target for integration. ERP holds, as it were, the purse-strings of the enterprise and is indeed in an enviable position to offer an integration platform for a diverse and varied range of business activities. Talking to vendors and users of ERP systems (or of ‘e-business for that matter) is a hazardous venture. You may know what you mean by ERP, but the chances are that your interlocutor has a different slant—or possibly a totally separate world-view.

Oxymoron?

What is ERP? At its most simple (simple ERP—a fine oxymoron!) ERP is a fancy way of describing accounting and finance. The core component of ERP is the ‘transactional’. Things are bought and sold—the numbers are captured once and for all—and all the other information processes, consolidation, reporting ripple through the system. Information thus captured can be re-used for decision support analysis and forecast—greatly leveraging the system from its simple accounting role.

Transaction

But the leveraging potential of ERP, along with the ERP vendor’s need to show revenue growth by expanding into new sectors are also a potential pitfall for implementers. Because the transaction is at the heart of so many business processes, it is tempting for ERP deployers to let project scope creep get the better of them. This problem is compounded by the way ERP systems are sold. ERP systems do not come ‘shrink wrapped’! They are delivered as tool kits which have in the past proved too much temptation for systems integrators and seekers of synergy.

T2B

The last time we looked at ERP—back in 1999, such scope creep was all the rage. Technical to business integration (T2B) was one buzzword that kind of infused corporate IT with promises of massive synergies and savings. With the dot com boom raging in the equity market, the end of the last millennium was not exactly a time for half measures. Nothing short of a radical new way of doing business was likely to excite any enthusiasm from anybody for anything.

Dot.Con

I mention the dot com boom partly because I am in the middle of an excellent book – ‘Dot.Con’ by John Cassidy*. This short history of the internet bubble relates how vast amounts of more or less innocent folk’s cash was extracted from their pockets and 401(k)s and pumped into ridiculous valuations of companies with crazy schemes. I particularly liked his qualification of the ‘greater fool’ theory of investment – where you know that the stock you are buying is overvalued, but you believe that there is a ‘greater fool’ out there who is ready to pay more for it than you paid.

Unwieldy

Our re-visiting of the ERP space (see pages 6&7 of this issue) shows a distinct cooling of the ERP ardors. On one hand, T2B seems to have retrenched. On the other hand the mainstream ERP implementers seem to have had a hard enough time simply deploying their software to worry much about what’s going on around the periphery of their field of view. This reining-in of the expansionist view of enterprise IT is due to the fact that expansion can create an unwieldy mass of complexity revealing weaknesses in design and problems of scope and demarcation. ERP systems are unlikely to be delivered shrink-wrapped.

Thorny issues

Customization during and after implementation means that systems may come from the same vendor—but end up significantly different. Maintenance and upgrade become thorny issues. Companies may be more concerned about getting the core components of finance and accounting to work properly first. This can be a significant problem as our study reveals—many companies are still fighting to get their reporting back to the state it was in before implementing ERP! Another argument against excessive expansion is the fact that in most peripheral domains, there are already specialist incumbents who are leery about the ERP vendors intent. There is a fascinating dynamic here, played out time and time again between vendors, consultants and in-house development teams. One result of this rapport de force is that an ERP vendor (like any other major integrator) will encourage dilettante in-house developers and consultants to ‘integrate’. But such a facility may be denied to incumbent vendors operating in spaces close to, or overlapping with one of their intended expansion targets. Vendors astutely allow their clients to ‘buy AND build’ - providing them plenty of rope to tie themselves in knots with. This behavior has been a major contributor to the ‘tower of Babel’ type deployments we see today.

Solution?

A degree of constraint on ERP is very much in line with modern thinking of enterprise IT. Decoupled systems and lightweight messaging with XML are all the rage. We report on one outsourced provider for whom this activity itself is core business. These fascinating developments may cause some to reflect on how much ‘integration’ they really have within the company firewall. Integration is no longer about who does what or where. Integration is a state of mind which comes from a close coupling of IT strategy with business objectives.

* Dot.Con—The real story of why the internet bubble burst. John Cassidy 2002. Penguin Books ISBN 0-141-00666-8.

After announcing ‘record’ fourth quarter 2002 earnings of nearly $100 million in February, Core Laboratories was forced into an embarrassing restatement of its 2002 results following an accounting snafu. A variety of accounting errors caused CoreLab’s earnings for the full year to fall by 48% - down from 44 cents to 23. The revisions stem from the issuance of duplicate invoices in the company’s Mexican operations, higher provisions for doubtful accounts receivables, ‘timely’ booking of expenses and foreign exchange losses, changes in the estimated life of certain assets and the consolidation costs of two Nigerian offices.

Controls

CoreLab stated that it has taken ‘immediate steps’ to modify the activities and control procedures that led to the restatement – including firing some managers and field accounting staff. The company has also boosted its internal control and audit and corporate accounting functions. Speaking to analysts, CoreLab officers explained that “heads have rolled” and new accountants and internal auditors have been hired and staff provided with enhanced training. Core’s reservoir management facility in London has been closed. A new ERP system was installed in December 2003 which should help in the future.

Class actions

Following CoreLab’s announcement, four law firms have instigated class actions against the company for issuing ‘a series of materially false and misleading statements to the market throughout the Class Period which statements had the effect of artificially inflating the market price of the Company’s securities’. Core management is sanguine about the problems. Four officers of the company purchased a total of $100,000 of the company’s stock last month and the company is ‘very active’ in stock buy-back at current stock levels.

Oracle 11i

Acknowledging these accounting issues should have been spotted more quickly, CoreLab is to augment its Enterprise Resource Planning (ERP) tools with the acceleration and expansion of a new global enterprise-wide financial reporting system. Based on Oracle 11i Financials, the internet–based system is designed for organizations with dispersed locations.

See inside this issue of Oil IT Journal for our special report on ERP systems in oil and gas.

The Society of Petroleum Engineers (SPE) has teamed with Application Service Provision (ASP) specialist Petris Technology to provide applications to SPE members through its website www.spe.org. The new ‘E&P Toolbox’ service will be available from May 19 and will provide SPE members with access to applications from vendors such as Edinburgh Petroleum Services, TH Hill, Texas Computer Works and others.

Young

SPE president Andrew Young said, “SPE is pleased to add the E&P Toolbox to spe.org, our members’ knowledge portal. This addition expands the resources available to our members and gives them tools they need to tackle the many challenges of producing oil and gas.”

Pritchett

Petris CEO Jim Pritchett added, “This collaboration is an indicator that the time for an industry-specific, vendor-neutral ASP service is here. More and more software vendors will be attracted to the concept and that will generate more synergy and, in turn, more clients. Costs will be lowered and service levels will benefit.”

IHS Energy VP Tim Hopkins and and Tim Loser, application specialist with Spotfire Inc. co-hosted a web cast earlier this month vaunting the merits of coupling Spotfire’s analytical capability with IHS Energy’s massive datasets. Spotfire is used by companies like Anadarko, BP, ChevronTexaco, Amerada Hess and Halliburton as an analysis and decision support tool. Several of IHS Energy’s US clients are also Spotfire users.

P 2000

The companies have collaborated on three proof of concept uses of Spotfire as an analytical front-end to data in IHS Energy’s PIDM/P2000 database. The pilots covered studies of success ratios, drilling performance and bypass pay. IHS plans to offer consulting support for modeling Spotfire to the US-focused PIDM data sets – with a possible extension to the international IRIS 21 database.

Success rate

The demo involved a large independent oil company’s evaluation of a new property. Spotfire was used to query and display PIDM data to produce ‘activity plots’ of wells coming on stream, showing which companies got better initial rates. Color coding of map views highlighted various combinations of operators and production metrics. The tool was used to define ‘success’ as a particular metric and to determine, from the historical data, the likelihood of a certain criteria being achieved. A success ratio (defined as a minimum 250 bbl/day initial production) was used to reduce the number of operators down to a peer group of the top ten operators in the area.

Process guide

Once a particular Spotfire methodology has been certified, it can be ‘encapsulated’ in a common process guide and stored as a ‘wizard’ for later use. The process can then be repeated on all fields in an area—by operator—or by productive zone. The process guide lets investigators test different parameters for in-depth analysis. Tom Hopkins believes that Spotfire ‘improves the value of the horribly underutilized data in IHS’ databases’. En passant we would like to note how a recorded Webex demo improves the value of an online web cast!

Kelman Technologies (KTI) has appointed Don Chitwood VP seismic processing and Greg Hess VP data management. KTI USA president Paul Huff has resigned to pursue other interests. Ken Tornquist is to manage KTI’s newly-opened office in Oklahoma City.

PPDM Association

Scott Beaugrand, CEO of the Public Petroleum Data Model Association has left the Association. Trudy Curtis has been promoted to CIO and Joe Tischner taken on as director of business development.

IFP

Olivier Appert has been promoted to Chairman and CEO of the French Petroleum Institute (IFP), replacing Claude Mandil who has moved to head up the International Energy Agency.

PGS

PGS has completed the latest phases of its central and southern N. Sea Mega Surveys which merge a large number of massive 3D datasets into a massive 3 terabyte regional seismic library. PGS also announced a staff reduction of 250—part of an ongoing program to save $ 75 million costs.

Schlumberger

Schlumberger Information Solutions has launched a new online technical support newsletter ‘The Click’—the web-based successor to the printed GeoQuest Bulletin.

ESRI

ESRI Petroleum Manager Andrew Zolnai pointed out that the tally of GIS usage in the pipeline industry (as reported in Oil IT Journal Vol. 8 N° 1) looks rather different when ESRI’s ‘exclusive partners’ Geofields, MJ Harden and Tobin are included—boosting the ESRI camp to a healthy 42%.

KSI

Knowledge Systems has hired Shane Knutsvig as sales manager and Gemma Keaney as head of geomechanics.

Energy Security Council

The Energy Security Council and the American Petroleum Institute is co-hosting seminars on security and vulnerability assessment (SVA) in Houston, Los Angeles and Trenton New Jersey later this year. A keynote address will be given by Jim McDonnell, Director of the Infrastructure Protection Division at the Department of Homeland Security (DHS). The API and DHS are developing methods and guidelines for petroleum industry SVA.

Fakespace

VR specialists Fakespace Systems has merged with Mechdyne Corp. Mechdyne’s Chris Clover will be CEO of the new company and Fakespace president Carol Leaman serve as President.

Landmark

Landmark Graphics Corp. has granted $2.6 million in integrated software and services for geosciences research at The Center for Spatial Analysis in the FedEx Technology Institute, at The University of Memphis.

Landmark Graphic’s ‘affiliate’ Magic Earth (ME) is releasing a new version of its high-end seismic interpretation package. GeoProbe 2.7 supports 3D well planning and an advanced ‘ezTracker’ capability and 3D well planning.

Lane

Landmark president and CEO Andy Lane said, “Finding and acquiring new reserves requires robust and accurate prospect evaluation, E&P experts utilizing GeoProbe will be able to evaluate and generate prospects even in the most challenging reservoir environments.”

Integration

GeoProbe now includes support integrated well planning using Landmark’s Wellbore Planner. GeoProbe 2.7 also includes the ability to view 2D seismic lines. ME CTO Yin Cheung added, “GeoProbe 2.7 helps interpreters reduce prospect risk by allowing them to spend more time on comprehensive reservoir analysis rather than on the mechanics of traditional line-by-line type interpretation.”

OMV is rolling out the latest version of IHS Energy’s E&P portfolio management package AS$ET. OMV uses AS$ET to evaluate investment opportunities and to model its existing portfolio.

Roithinger

Hans Roithinger, economist at OMV said, “One key benefit for us is increased standardization. AS$ET contains ready-to-use country files, including fiscal systems, ensuring consistent results. We have tested other economics tools and chose AS$ET because of its excellent price-performance-ratio.”

Release 3.1

The latest version, release 3.1 includes a new interface designed to enable non-economists and novice users to perform quick-look evaluations.

Scott

Candida Scott, director of Economics Projects at IHS Energy said, “In some situations, AS$ET has achieved a 20 percent difference in outcome of post-tax predictions for a country, when compared to traditional stand-alone techniques”.

Monte Carlo

An upgraded Monte Carlo module uses statistical simulation to include post-tax scenarios for component projects. A custom template enables users to create reports in company-specific formats. AS$ET is supported by IHS Energy’s information gathering and reporting services, including PEPS and GEPS, which ensure fiscal models are based on in-depth and timely data.

StereoGraphics Corp. has just launched two new 3D displays using its glasses-free SynthaGram technology. SynthaGram uses lenticular technology to create ‘realistic’ 3D still and moving images. The top of the range SynthaGram 222 offers ‘phenomenal’ 3840 x 2400 pixel resolution—approaching ‘photographic-quality’ realism.

Multiplicity

SynthaGram works by projecting nine separate perspectives on the surface of the screen. The process was originally invented in 1908 and is considered to be a precursor of holography. A refinement of the original technique involves ‘corduroy-like vertical lenticles that refract only in the horizontal direction.’

$17,995

StereoGraphics also supplies content-creation tools including plug-ins for 3D Studio Max. The Synthagram 222 retails at $17,995. Another model sports a 42" display suitable for glasses-free 3D demonstrations in tradeshows. More from www.stereographics.com.

An article in the latest edition of BP’s Frontiers Magazine reveals a massive investment in in-house seismic processing technology. BP’s Houston-located high performance computing (HPC) facility uses Intel’s latest 64 bit Itanium 2 processors in a Hewlett-Packard cluster running Linux. Each cluster node has four processors and 32 GB of memory. The system has 259 nodes and a total of 170 TB of disk storage. Bandwidth is quoted at 7.5 TeraFlops an total system cost is around $ 15 million.

Buy not build?

Comment - BP has a reputation for focusing on ‘core business’, outsourcing and vigorous ‘downsizing’. Does spending $15 million building a computer (when excess seismic processing capacity abounds) represent a departure from this philosophy? Is this a case of ‘bye-bye buy not build’? Perhaps a cost center like Thunder Horse allows for a certain largesse in what’s ‘core’ to BP’s geophysical grandees. �

Statoil has selected GeoKnowledge’s ‘GeoX’ risking software for analysis of seismic direct hydrocarbon indicators. Statoil has selected GeoX for company-wide implementation. GeoX uses Bayesian statistical analysis of seismic anomalies to determine the likelihood of success before drilling. Statoil reached its decision after testing of other techniques and an in-depth review of GeoX’s technology.

Veding

Statoil advisor Hans Martin Veding said, “We sected GeoX because it is mathematically rigorous and consistent with our prospect risking methodology. Users find the software easy to use and transparent. A major learning has been that GeoX has forced us to focus on alternative explanations for seismic anomalies. This helps avoid ‘success case bias’.

Stabell

GeoKnowledge CEO Charles Stabell added, “GeoX evolves in response to customer demand. We are pleased that Statoil has chosen to extend its use of GeoX and look forward to continued cooperation on the effective use of our tools.” More from www.geoknowledge.com.

A better NAS?

Following an in-depth investigation of current storage management Ovation has concluded that the ideal solution is one which combines both NAS filers and tape. Ovation has therefore teamed with NAS Filer vendor Spinnaker Networks and Sony to provide dual media storage solutions.

Sony

Ovation has purchased the new Sony PetaSite CSM-200B mass storage tape library, based on SAIT technology. The new PetaSite CSM-200B library has up to 108 terabytes (TB) native capacity in a single 19-inch cabinet, with a scalable total native capacity up to 1.2 petabytes (PB).

Spinnaker

Ovation’s partnership with Spinnaker Networks offers a two-stage distributed file system. Spinnaker’s NAS offers scalable, centralized management for data sharing among Unix, Linux, and Windows clients. Spinnaker’s clustering technology can be deployed in up to an 11 petabyte file system.

The American Petroleum Institute (API) has ‘formalized’ the relationship between its Petroleum Industry Data Exchange (PIDX) unit and the Petrotechnical Open Standards Consortium (POSC). The bodies are to work together to ‘develop and support technology-neutral electronic business and data standards for the oil and gas industry’.

E-transactions

POSC and PIDX have been working on industry standards for over ten years. POSC’s traditional focus has been in technical data definition and usage in the upstream. PIDX has hitherto focused on inter-company electronic transaction formats.

LMI

PIDX also recently contracted Logistics Management Institute (LMI) to develop its XML business standards. LMI is to augment PIDX volunteer technical support to maintain existing PIDX XML standards, develop new standards, and track the work of other standard organizations on behalf of PIDX.

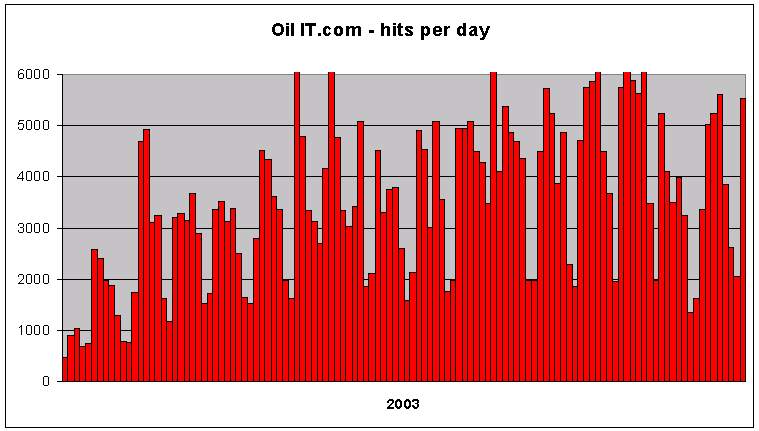

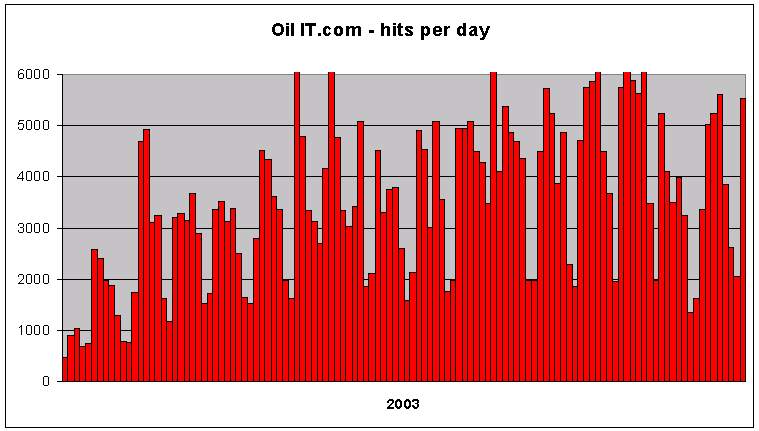

The companion website to Oil IT Journal—www.oilit.com continues to see strong growth. Oilit.com currently receives around 500 distinct visitors and some 5,000 hits per day (see graph). The website includes a contributed papers section, a buyers guide and current headlines from Oil IT Journal. The latest addition is a discussion forum. Check here for discussion on matters arising in Oil IT Journal.

SAP

The head of SAP’s oil and gas division Dieter Hasslein believes that with ongoing industry consolidation, we are entering a ‘post hype’ period where companies are determined to ‘realize the value’ of IT investments. One growth area is the interface between oils as Owner Operator (OO) to service sector Engineering Prime Contractors (EPC). SAP’s customers in both OO and EPC were two separate markets. Today, operators may ask the EPC to implement IT infrastructure which will be handed over upon commissioning. Bechtel or Halliburton may build inside their own IT environment and then migrate plant data to the OO’s system on handover.

NetWeaver

SAP’s new NetWeaver tools can be used for such data migration—or to access data resident in the EPC environment from inside the OO’s SAP system. More new technology—SAP’s ‘Master Data Management’ will be released later this year and will provide tools for content consolidation, data harmonization and management across disparate existing data sources.

T2B

Hasslein considers technical to business integration as a complex problem which is ‘neither a data nor a pure technology problem’. There are ‘extra dimensions’ of knowledge, semantics and of the business process itself. An example of this is Shell’s use of NetWeaver to integrate internal procurement with suppliers and public markets such as Trade Ranger (‘very important to Shell’). SAP claims 80% of the oil and gas ERP market.

Total Fina Elf

Oil IT Journal spoke with Jean-Pierre Foehn, VP business development with TFE’s Global E-Procurement Project. TFE’s interest was sparked when president Thierry Desmarest was invited by Shell’s Mark Moody-Stuart and BP’s John Brown to join them in a new e-venture, Trade Ranger—operating in the emerging internet businesses space of supply and procurement.

E-impact

Along with Trade Ranger involvement, TFE recognized that it needed to track activity in the e-procurement space and to determine which domains, technology and services would be impacted by e-business. TFE is also involved in upstream geoscience, drilling and other technical computing particularly through working over the web with ASP technologies.

Purchasing

Today, TFE performs online calls for tender and its gas stations purchase supplies from catalogues provided internally or by external providers including Trade Ranger. Technology assures authentication and delivery. Billing through Trade Ranger is ‘emergent technology’. TFE is also looking into e-procurement of services such as logging, painting offshore platforms, engineering and online travel—all again leveraging external service provision. It should be noted that e-procurement is embryonic today, of TFE’s € 20 billion non oil procurement, only around € 10 million is e-procurement.

Oracle

Scott Shemwell, VP of Oracle’s energy sector, explained how Oracle’s web-based infrastructure is built in tiers – allowing for support of a broad range of industries by building base capabilities and customizing to vertical through a partner. The top-tier oil and gas offering includes a vertical component from Novistar (now a Petroleum Place company).

Novistar

Oracle clients like Unocal host instances of Novistar Production Suite at Oracle’s data center allowing for web-enabled data and asset management. Other Oracle/Novistar clients include Kerr McGee and Oxy. Shemwell believes that e-buisness is ‘moving away from exchanges into asset management’—particularly in engineering and the ‘e-oilfield’ where Oracle claims a ‘complete solution for facilities, finance and project lifecycle management’. Oracle’s ‘collaborative engineering’ suite offers supply chain and asset management all written to one instance of Oracle.

SAIC

SAIC VP Angela Minas figures that most major oil and gas companies have now deployed their ERP (usually SAP) systems. So the work that remains is generally with smaller companies which have not yet deployed—or with larger companies seeking to get a better return on their ERP investment. In both cases, SAIC believes that business process reengineering and reengineering is critical. ‘Don’t assume that the right processes are in place’. Pre-implementation projects show that around 85% of the cost benefits are not directly ERP-enabled. A recent SAIC study for an independent oil company showed that while $3 million of annual cost savings could be attributed to the ERP system—an extra $13 million would come from BPR.

Data Warehouse

Minas notes that most majors deploy data warehouse technology alongside ERP systems. Often companies have a tough time simply getting their reporting back to where it was before they embarked on ERP! The goal of one-time data entry and ‘push button’ reporting turned out to be a ‘fantasy’ according to Minas. “These are very complex systems! Folks who implemented them did not correctly evaluate the real business needs. There was too much IT-driven work and poor liaison with business.” Minas warns, “The cost of an ERP system can easily run to hundreds of millions of dollars. The costs of pre-ERP financial systems are just not high enough to show significant ROI on this kind of investment. Even with BPR it can be hard achieve significant financial benefits!”

Enertia Software

Enertia Software was founded in 1983 to develop oil and gas software for the PC. In 1996 Enertia ‘threw away’ 3 million lines of DOS code and 29 modular applications and re-built a ‘fully relational’ oil and gas ERP solution on a Microsoft SQL Server 2000 platform. Enertia is a ‘completely data-driven’ application powered by a data model with about 1800 tables of information. Enertia includes field data capture, production accounting and regulatory reporting, product pricing, revenue distribution and many other facets of upstream ERP.

Major in merger

Oil IT Journal spoke with the ERP specialist in one major who wished to remain anonymous. In the throes of post-merger rationalization, our ‘deep throat’ told us, “B2B is the buzz that is bringing our companies together. Both companies are SAP users and current activity is focused on merging two R/3 systems. Even with SAP in both units, implementations were done differently. Different tools were deployed, data structures and business processes also differ. Having said that, SAP is absolutely core to what we are doing in the area of financial and transactional process management. Other relevant tools in this space include Novistar, Tobin, Microsoft Exchange, Office and SharePoint, and SAP’s Document Management System.”

Friction

“On the e-business front we have noted the entrenched positions of vendors and purchasers who are rightly concerned that their wares are not reduced to commodities. It is natural that there is friction as these strategies are fleshed out. But basically, Trade Ranger is a good idea.”

ElectroBusiness

ElectroBusiness’ (EB) technology facilitates the exchange of transactional information between oils and vendors. EB works outside of company firewalls and independently of B2B hubs. EB claims ‘one time’ integration. By mapping processes to EB, vendors can transact with clients deploying JD Edwards, SAP or a ‘home-grown’ ERP system. EB currently serves BP Canada and queries BP’s database to check invoice conformity before posting to the ERP system. Data cleanup is ‘an important part’ of EB’s service offering. EB is an approved integration network for OFS Portal members in Canada.

MRO Software

MRO Software’s ‘strategic asset management solution’ was originally developed for production assets but now extends to IT, offices, accommodation and transport fleets—facilitating outsourced management of retail outlets for Shell in the UK. Maximo gives operators a handle on downtime, showing which equipment and assets really impact the business, and optimizes maintenance. Unplanned maintenance costs are an order of magnitude more than planned work. Maximo also measures ‘days away from work case frequency’ (DAFWCF) – a key measure of safety performance.

Schlumberger

Bill Baksi told Oil IT Journal how Schlumberger Information Solutions is leveraging its Decision Point E&P Portal (DP) as an enabler for technical to business integration. A recent case study centers on Pioneer Resources which uses DP for role-based access into disparate data sources including ERP and production. Pioneer’s head office in Irving has ‘ubiquitous’ web access to data in acquired by units operating in Canada and Argentina. All data from SCADA systems up is current. DP integrates Pioneer’s production data with its legacy ERP system running Premas on an AS/400. Elsewhere DP—described by SIS as ‘portal agnostic’—integrates Oracle Financials, SAP, JD Edwards with technical data sources.

Trade Ranger

Trade Ranger president John Wilson believes that oil and gas is immature as compared to industries like manufacturing—where online processes certify suppliers, help them cut costs and improve product—without squeezing suppliers’ profits. Trade Ranger wants to bring similar efficiencies to oil and gas. Supplier/buyer relationships should be built on a quid pro quo and avoid the kind of price pressures associated with auctions—an area that Trade Ranger tries to avoid.

Volume

Wilson believes synergies and economies stem from rationalizing the transaction processes and developing catalogues. The focus is on high volume low value transactions, where transaction costs can be driven down through process automation. Trade Ranger has developed Trade Ranger Open Content Standard (TROCS) – a catalogue standard which is customized to individual transaction types. Vendors and suppliers can hard-wire their own business rules into TROCS so that TFE may deal differently with Halliburton than BP for instance. Trade Ranger has been in the cross fire between buyers and suppliers. But Wilson believes this is set to change. “2003 will be the year that vendors and suppliers achieve non-threatening relationships through Trade Ranger”.

Google-like search engines can be used to find masses of information in unstructured documents. But ‘masses’ doesn’t always equate to ‘useful’. How do you ensure that a ‘well’ is the same thing across all the stuff you are searching. Or as the web’s architect-in-chief Tim Berners-Lee would put it, how do you build the next-generation ‘semantic web’. The answer, according to a new report from Ark Group lies in the methodical implementation of taxonomy.

Dewey

Taxonomy is about building lists of key words, and using these to organize and search documents. The grand-daddy of taxonomies is the Dewey Decimal classification, used by librarians to determine where to put books on shelves. Modern taxonomies can be more complex – with hierarchies and linked lists – although there is a lot to be said for keeping your taxonomies simple. The science of taxonomy naturally enough uses some pretty fancy words itself. A thesaurus is just a list of words used in the taxonomy—but ontologies? These define relationships between the members of a taxonomy—belongs to, is a parent of etc. Knowledge, or topic maps can be used to give visual representations of taxonomies.

Irony

But definitions are not easy as ‘Taxonomies’ reveals, “The problem is that the definitions of taxonomies, ontologies and knowledge maps tend to overlap. The irony is that one of the most important attributes of taxonomy is the exact and unambiguous application of terminology.” Taxonomies can be used to drive document creation—by making sure that consistent terminology is used and the documents are classified up-front in a meaningful way. Failing this, when confronted with a morass of legacy or public domain documentation, software can be used to ‘seek meaning’ by applying taxonomies to intelligent searching.

Useful

Theory apart, ‘Taxonomies’ starts to get seriously useful (as opposed to stimulatingly interesting) around page 50 (a little late in the day for an 80 page book!) with a short review of commercial taxonomy software. Software-based classification can be manual (Multites) with a visual tree structure of terminology available to the manual indexer. Alternatively, standard templates can be customized for use in specific industries (Sun One). Finally, automated classification (Autonomy etc.) can extract meaning from free text. The section concludes with a discussion of various automated taxonomy engines from Autonomy, Verity, GammaWare ( a table compares functionality of products from 20 or so vendors) along with pointers to research on vector analysis and ‘rough sets’. This review of off-the-shelf software comes with a health warning as one quoted ‘expert’ says “The solution is not to buy software that will do a poor job of classification. The answer is to start creating less content of a higher quality – and to integrate classification into the content production process. But can your people write well to begin with? Do they have the skills to write clear headings and organize their documents into a logical and readable manner?”

Experts

The answer to the last question, so far as ‘Taxonomies’ is concerned, is unfortunately no. ‘Taxonomies’ is jam-packed full of enlightening quotes, but these are all slotted under the same header ‘what the experts say’. This wouldn’t be so bad if the overall structure of the book was better organized. The one exception to this is the executive summary which for those of you in need of some rapid boning-up on this trendy topic is probably worth the purchase. In summary if you are looking for a kick-start cookbook to using XML to build the semantic web, this is not the book for you. ‘Taxonomies’ offers a philosophical ‘divertissement’ with a multitude of inspirational quotes ‘from the experts’ and a very top level overview of taxonomy-oriented software. But the review is more of a ‘bluffers guide’ than a textbook.

Taxonomies: Frameworks for corporate knowledge. Jan Wylie, Ark Group. ISBN 0-9543897-1-9. info@ark-group.com.

VoxelVision will be rolling out its new turnkey solution for processing and immersive visualization of geophysical data at the EAGE exhibition to be held in Stavanger next June 2. GigaSphare is the result of a collaborative development by VoxelVision and visualization specialist 3D Perception.

Bundle

GigaSphare is designed for small rooms and is delivered as a hardware and software bundle along with support frames and installation material. Installation normally takes a couple of days. GigaSphare will be demoed at the EAGE Exhibition on an 8 CPU, 20 Gb RAM Linux cluster, GIGAviz 2.0 software, dual CPU client PC and a fully edge blended 3000 Lumen dual DLP projector system with 1600x1024 image projected onto a spherical screen measuring 4,8m by 2.2m. A complete GigaSphare setup with hardware and software will be available at the EAGE at the discounted price of $175,000.

Statoil

In a separate announcement, VoxelVision has revealed that Statoil is to acquire GigaViz licenses for use in 5 different asset teams. In what is described as the start of a cooperation, VoxelVision will provide Statoil with its cluster technology for use in interpretation and visualization. In return, Statoil will provide feedback for inclusion in forthcoming releases of GigaViz.

OFS Portal is expanding its relationship with ChanneLinx to build a ‘business framework’ for OFS Portal members to transact electronically with trading partners. Last year (Oil ITJ Vol. 7 N° 2) OFS Portal adopted ChanneLinx’s e-catalogue content management system. In the current deal, OFS Portal is to deploy ChanneLinx’ transaction management service.

Web DI

Web DI facilitates the exchange of business documents and data between trading partners with disparate back-office systems. WebDI reformats trading partner’s business data on the fly. Even non-automated companies can achieve EDI compliance with WebDI’s eForms service.

Novak

ChanneLinx VP Bob Novak said, “OFS Portal has already uses the ChanneLinx content management application. Adding WebDI for document exchange shows how our services and applications can combine to assist organizations to achieve their e-commerce goals.”

Le Sage

Bill Le Sage added, “This agreement facilitates e-business for ChanneLinx and OFS Portal members. These services provide our members with cost-effective transaction document routing, streamlining payment cycles, improving productivity and reducing costs.”

Nexen Inc., the Canadian Petroleum Technology Alliance (PTAC), the Public Petroleum Data Model Association (PPDM) and e-business specialist Know2Act Corp. are in the process of developing an XML-based standard for the exchange of information relative to acquisition and divestment (A&D). The new standard will be designed to ‘maintain data integrity, facilitate easy access, and reduce operational overhead’ during the exchange of data within and between companies involved in A&D.

Kickoff

Around 70 turned out for the kickoff meeting held in EnCana’s offices to hear the PPDM association’s proposal for a data exchange format that will ‘satisfy the technical and business requirements of E&P companies, service companies and vendors’. The new standard will leverage existing PPDM work on XML along with the association’s data model.

Sponsors

Project scope will cover the information typically contained in non-confidential initial offering memorandums prepared by broker companies. A draft Project Charter is available and the association is seeking financial support and volunteer help for the project. PPDM will run the project under its 2003 Data Exchange Project. More from www.ppdm.org/development/projects/exchange/index.html.

Houston-based Quorum Business Solutions Inc. has entered into an agreement with Shell Gas Transmission and Oklahoma-based Enogex, to license, implement and support Quorum’s contract management system. Contract management is a component of Quorum’s Energy Suite and is an enterprise-wide central contract repository that supports all contract management business processes.

Contract repository

Shell will use Quorum’s system to manage contract information across multiple assets and legacy applications. Enogex will use it to capture detailed contract information and store that information in a centralized repository to facilitate the management of contracts across the enterprise.

Post-Enron

Quorum believes that the central management of contracts and contractual relationships is important in the ‘post-Enron world’ where credit risk and counter-party credit issues have badly hurt the entire industry.

Forefront

With the absence of other software on the market that addresses the contract management issue in a current context, Quorum is in the forefront of this technology, he says. Quorum provides the Quorum Energy suite, a set of software applications for the energy industry that includes TIPS (Plant/Facility Accounting), the industry-standard solution for gas plant accounting.

Statoil has reorganized its corporate IT, consolidating 15,000 Windows 2000 workstations and 500 UNIX workstations into one company-wide infrastructure. Network Appliance (NetApp) has provided networked data storage in what is described as a ‘major redesign’ of Statoil’s systems architecture.

Myge

Statoil IT ops manager Kjell Magnus Myge said, “We wanted to consolidate our systems into a simple and more manageable environment, while increasing data availability and reliability.

Windows 2000

This led to a company-wide adoption of Windows 2000 and a unified data storage solution from NetApp. Stability and reliability have been excellent and we have made considerable savings in total cost of ownership.”

90 TB

Statoil’s seismic R&D makes its storage requirements considerable. Statoil’s previously fragmented 90TB of data was consolidated to 22 NetApp systems. The project led to savings in operational costs, capital expenditure and improved access to critical business data.

The Calgary-based Public Petroleum Data Model Association (PPDM) is fleshing out its proposal for an XML-based well header description. A preliminary meeting has established a base-set of attributes for the well header document and the well header workgroup is currently seeking comments from the PPDM membership on the new spec.

High-level

The well header schema is designed as a high level module to be used in conjunction with other well information sets such as directional survey, logs, tests, cores, operations and activity reports. The information defined in the well header is also expected to satisfy multiple business processes including applications, regulatory submissions, daily drilling, and operational reporting.

PPDM V3.6

Initial mappings to the PPDM 3.6 data model are included in the specification which is available for review on www.ppdm.org/ftp/public/xml/wellheader.html.

Amerada Hess has selected Emerson’s process performance monitoring solution ‘e-fficiency’ to provide real-time performance monitoring of its ‘Scott’ N. Sea platform. e-fficiency will be used to track performance of centrifugal compressors, to enable maximum performance gains and to anticipate preventive maintenance.

BP

BP also recently selected Emerson as technology partner on the development of an expert system for plunger wells, based on Gensym Corp.’s MaxGas expert system. Data from field-based real time units and SCADA systems is routed to the expert system which uses ‘fuzzy logic’ to determine optimization strategies. MaxGas offers ‘intelligent alarming’ when abnormal conditions are encountered—suggesting corrective actions to operators. Asset Optimization leverages Emerson’s PlantWeb infrastructure to automate the flow of information on asset reliability and performance.

ExxonMobil’s Richard Wylde wrote Oil IT Journal to correct our mis-reporting of his talk to the ESRI Petroleum User Group in last month’s Journal. “My talk was not about the ‘mismanagement’ of coordinate reference systems as you indicated, but about applications using incorrect parameters and incorrect naming— the inability of most E&P applications to maintain co-ordinate integrity over a large geographical area covered by a single datum such as the N. Sea. Most software links the datum name with the transformation parameters at time of project set-up. The fact is that you do not need to ‘transform’ co-ordinate data unless you change the datum. Basically what we are seeking is standardization of nomenclature, parameters and algorithms—and the use of International Standard data exchange formats such as the UKOOA P formats both for import and export of data.”

PetroChina has selected Paradigm’s Geolog well database to manage and interpret petrophysical logs for 15 oil fields in China. The high-end Geolog configuration includes Facimage, Geomage, NMR processing and the corEval core analysis system.

Stratimagic

Paradigm’s Stratimagic seismic facies classification and analysis solution is also included in the transaction.

Xuelin

Jiao Xuelin, Paradigm’s Beijing chief of staff said, “This deal is a major breakthrough into the Chinese market, and an endorsement of our top-of-the-line reservoir characterization solution, which includes both Geolog and Stratimagic.”

Weiss

Paradigm CEO Eldad Weiss added, “Our Beijing office provides ongoing support and consulting to our Chinese customers—helping them maximize the benefits of our software solutions. We look forward to a long and mutually beneficial relationship with PetroChina.”

BHP Billiton has selected Austin Geo-Modeling’s Recon 3-D geological interpretation software, for use in BHP’s Houston offices. Under the agreement, AGM will provide an unlimited number of Recon licenses for use on BHP’s desktop geological workstations as well as in its 3-D visualization center.

Next generation

BHP and AGM have been cooperating on the development of ‘next-generation’ 3-D geological interpretation tools, designed to speed up geological workflows and to reduce risks.

Saudi Aramco

Austin Geomodeling (AGM) introduced Recon at last year’s AAPG convention. Originally developed for Saudi Aramco, Recon was used to correlate and rebuild sequence stratigraphy over the Gawar field.

Stratamodel

Recon’s developers were previously involved in the design of Stratamodel and Z-Map Plus. Recon’s 2-D and 3-D visualization engines are based on the OpenGL standard 3-D graphics language. OpenGL leverages hardware-acceleration on a range of platforms including PC’s, Unix workstations, and supercomputers.

Environmental data specialists Geotech have come up with a novel marketing ploy a ‘software amnesty program’. Geotech claims that many users are not satisfied with their current environmental database management solution. Geotech is inviting unhappy environmental database users to switch to its own Enviro Data solution in its ‘amnesty’ program.

User-friendly

Enviro Data is a user-friendly tool for managing environmental quality data for petroleum and other organizations. One large oil company uses the software to store laboratory and field data for their refineries, transportation facilities, and processing plants, to generate regulatory reports, and to provide data for GIS maps.

Access

Enviro Data stores and displays site environmental data using Microsoft Access for the user interface and Access, SQLServer or Oracle to store the data. Users can cost-effectively import analytical and other data, review the quality, select data, and generate reports, graphs and maps, or provide data to other programs.

Lab and field

Capabilities include a lab and field data interface, data validation, a user-friendly selection screen, and integrated graphing, mapping and reporting. The software can be easily customized for specific project needs.

Read the book

Geotech’s Dave Rich wrote the book on the management of environmental data. Published last year, ‘Relational Management and Display of Site Environmental Data’ is also a very good introduction to data management in general and to the basics of relational database theory. The book starts with an overview of site data management concepts, and then progresses through relational data management theory, the design of the database tool, and implementing a data management system.

Relational management and display of site environmental data. David Rich, Lewis Publishers2002 . ISBN 1-56676-591-9, www.crcpress.com.

US regulatory group the Ground Water Protection Council (GWPC) has decided that XML is an ideal format for sharing data with oil and gas industry operators. The GWPC believes that XML data transfer offers a cost advantage over ‘traditional’ EDI. Also, XML development tools are now widely available.

MMS involved

The GWPC has coordinated the development of an XML schema for oil and gas production and injection. This two-year effort has included meetings with representatives of the Bureau of Land Management (BLM) and Minerals Management Service (MMS), workshops, state agency conferences, and pilot studies funded through grants from the Department of Energy (DOE) and the participating states.

Reporting

Electronic reporting initiatives based on this schema are now being launched in Colorado, New York, Montana, Alaska, Utah, Nebraska, and Pennsylvania. The XML schema gives agencies a common syntax and format for their data reporting elements even though implementations may differ from state to state. A certification process is currently underway through API and POSC. The schema can be downloaded from www.virtuales.com/xml/schemaVer3_5Doc/ereport3_5.html.

Consulting group Nucleus Research has just announced the results of a new study of users of SAP’s Enterprise Resource Planning Software. The report found that 57 percent of SAP customers interviewed believed they had not achieved a positive return on investment (ROI) from their SAP deployment.

21 companies

Nucleus studied 21 SAP clients with an average implementation cost of $5.4 million on license fees and deployment consulting costs. One ROI value destruction mechanism was ‘excessive customization’ along with consulting costs averaging over $3.6 million per implementation. For deployments in which consulting amounts to more than twice the cost of software, a positive ROI is unlikely. Customers with less customization and consulting requirements were more likely to obtain a positive ROI. Where customers did derive benefits, they came from increased productivity, reduced headcount, improved operations management, and improved information organization and access for decision making. Nucleus notes that despite such misgivings, SAP has posted tremendous growth and diversified its monolithic solution into discrete bundles of business applications.

Wettemann

Nucleus VP Rebecca Wettemann said, “Among the companies we have studied, SAP emerges as an anomaly with unimpressive ROI trends. However the prognosis isn’t as bleak as it is for other vendors’ enterprise software. Most of SAP’s customers expected a lengthy implementation. Companies that can manage this process without purchasing software that is beyond their business and functional needs, and without excessive customization of the solution and its interfaces, will be poised for significant benefits.” More from www.nucleus.com.

Shell Oil Products US has selected IQNavigator as the platform for external service procurement and cost control. IQNavigator’s software and services are to automate Shell’s procurement and spend management. The software is claimed to offer greater process efficiency, cost reduction, and spend visibility and control. Shell is to automate all of its contingent workforce and outsourced project procurement and spend management processes - including supplier qualification, requests for proposals, contractor and consultant selection and on-boarding, engagement management, time and expense entry, invoicing and payment.

Sitoski

Shell project manager Tom Sitoski said, “We evaluated a dozen services procurement and spend management solutions for the entire family of Shell companies and chose IQNavigator5 because it was the market leader in terms of the functionality and service options needed to take us to the next level in staffing. IQNavigator’s track record for rapid and successful implementations weighed heavily in its favor”.

Raeder

IQNavigator president and CEO John Raeder said, “The oil and gas sector will benefit from a single sourcing technology platform that supports cost-effective acquisition, contract compliance and use of contingent labor and project-based consultants”.